MBA vs. Master of Finance: Making the Right Choice for Your Future

Oct 26, 2023

Business administration and finance are essential in driving businesses and organizations toward success. They each hold significant roles in improving a company’s strategy and financial health. However, though they often work hand-in-hand, they have clear differences.

If you are interested in pursuing either one, it is best to be well-informed about which educational path better suits your ambitions and objectives. So, read on as we take a closer look at MBA vs. Master’s in Finance, considering factors like career path, courses, job opportunities and much more.

Understanding the Basics

The first distinction we should consider when comparing a Master's in Finance vs. MBA is their core focus. Understanding the fundamentals of each program will allow us to discern their unique attributes better.

MBA

The Master of Business Administration, commonly known as an MBA, is a postgraduate degree program that provides a comprehensive understanding of various areas of business management. This program encompasses a wide range of business-related subjects, including the basics of finance, accounting, marketing, operations and human resources.

If you are looking to move into executive or managerial roles within your organization, this is the degree for you. Our MBA program, in particular, is designed with working professionals in mind, allowing you to continue advancing in your career without interrupting your work. This way, you ensure that you remain competitive in today’s job market.

Master of Finance

A Master’s in Finance is a specialized postgraduate degree program focused exclusively on the field of finance. This program delves deep into financial theory, investment analysis, risk management and financial markets.

Unlike an MBA, which offers a broader overview of business management, a Master’s in Finance provides a more concentrated and specialized education in financial principles. Such a degree is ideal if you’re interested in finance-related roles, such as financial analysts, investment bankers, portfolio managers and risk analysts. Through such a program, you gain proficiency in financial modeling, portfolio management and corporate finance.

Alternatively, you could focus on one area of finance through a specialized Master’s in Finance, such as a Master of Science in Financial Analysis.

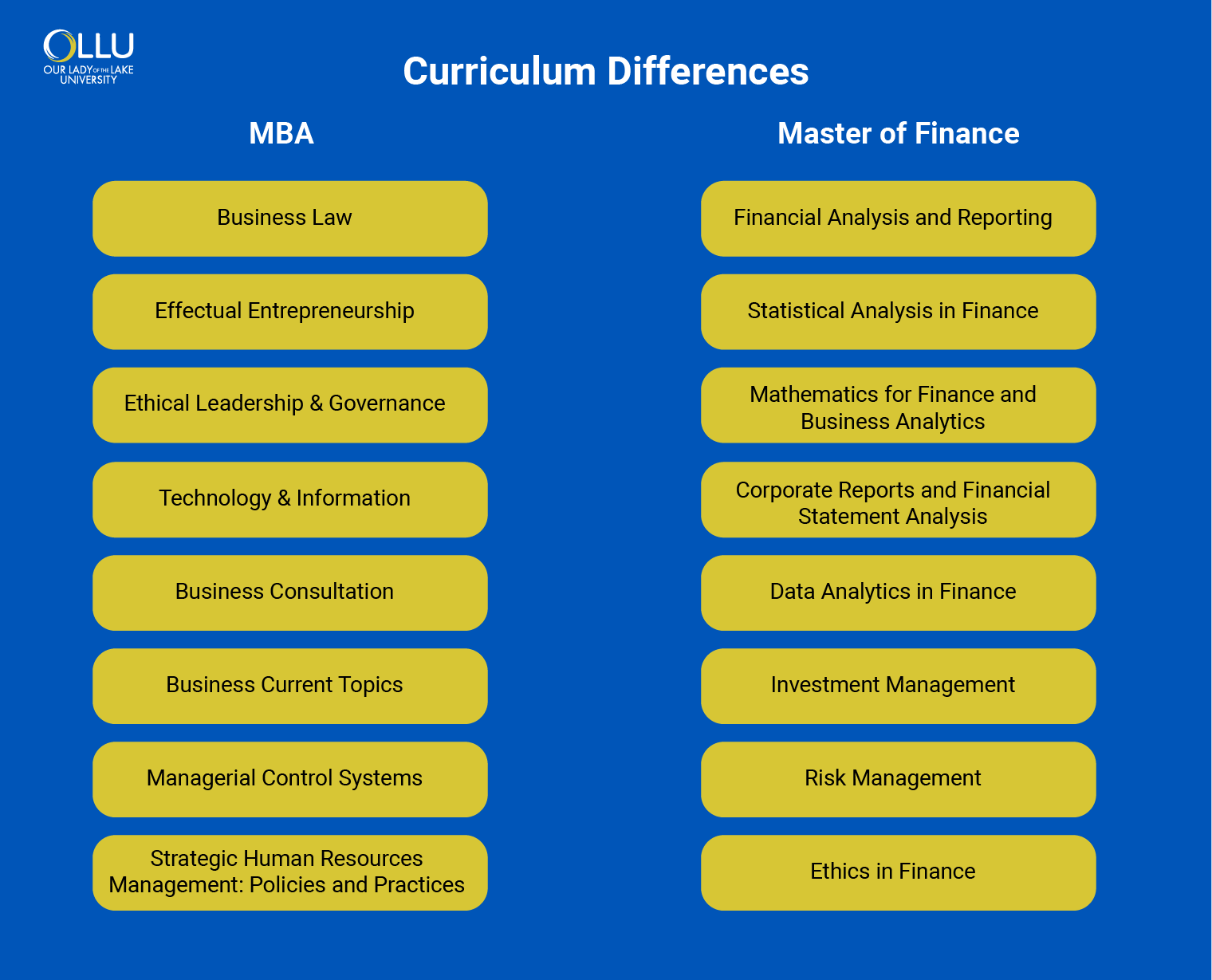

Curriculum Differences

Next, we’ll explore the typical curriculum for each program to gain a clearer understanding of the distinction between an MS in Finance and an MBA, highlighting the specific courses and subjects that shape each program.

MBA

MBA programs are recognized for their hands-on approach to business management, offering students a skill set essential for success in leadership positions, through courses like:

- Business Law

- Effectual Entrepreneurship

- Ethical Leadership & Governance

- Technology & Information

- Business Consultation

- Business Current Topics

- Managerial Control Systems

- Strategic Human Resources Management: Policies and Practices

Master of Finance

A Master of Finance degree program offers a specialized curriculum tailored to provide in-depth knowledge and skills in the finance field. The courses typically include:

- Financial Analysis and Reporting

- Statistical Analysis in Finance

- Mathematics for Finance and Business Analytics

- Corporate Reports and Financial Statement Analysis

- Data Analytics in Finance

- Investment Management

- Risk Management

- Ethics in Finance

Career Opportunities

Distinguishing between MBA vs. MS in Finance is also quite straightforward when considering the diverse career prospects each program offers. Below, we’ll look through some common career paths you can pursue with each degree.

MBA

As an MBA graduate, you are equipped to explore a multitude of rewarding career paths, such as:

- Financial analyst: Delve into financial data, undertake market research and provide valuable insights for sound investment decisions.

- Management consultant: Provide expert advice to businesses across various sectors on strategy, operations and organizational design, while identifying issues and proposing effective solutions.

- Marketing manager: Design and implement marketing strategies for products or services, oversee campaigns, analyze market trends and strive to boost brand visibility and sales.

- Healthcare administrator: Oversee the daily operations of healthcare facilities, manage staff, budgeting and ensure compliance with regulations, all to guarantee the highest quality of patient care.

- Director of operations: Optimize daily operations, ensure smooth processes and manage resources to achieve business goals.

- Entrepreneur: Conceive and launch your own businesses, develop innovative ideas, secure funding and tackle the challenges of starting and growing a business.

- Chief executive officer (CEO): Take charge of critical corporate decisions, set strategic goals and serve as the face of the organization to stakeholders.

Master of Finance

With a Master’s in Finance degree, you’re poised for a range of prestigious career paths, such as:

- Investment analyst: Dive deep into financial data, undertake market research and offer insights to guide investment decisions.

- Risk manager: Concentrate on assessing and curbing financial risks within enterprises.

- Portfolio manager: Lead the handling and performance evaluation of investment portfolios.

- Financial planning and analysis expert: Craft and review financial strategies that bolster business goals.

- Quantitative analyst: Use mathematical and statistical tools to shape investment strategies.

- Corporate finance specialist: Steer an organization’s financial operations and investment decisions.

- Financial consultant: Deliver tailored financial guidance to individuals or corporations.

- Private equity analyst: Probe into potential investments in privately held firms.

- Financial controller: Direct the accounting and financial reporting activities of an organization.

Skill Sets and Traits for Success

When comparing a Master’s in Finance vs. an MBA, it’s also important to consider the specific skills and qualities each program fosters to equip you for your future career.

MBA

An MBA program will help equip you with a diverse set of skills and traits crucial for success in business and management, such as:

- Knowledge of financial analysis and budget management

- Capability to develop and implement strategies to achieve organizational objectives

- Competence in conducting market research and analyzing the acquired data

- Proficiency in negotiation techniques

- Skill in planning, implementing and supervising projects

- Leadership skills

- Expertise in fostering innovation and entrepreneurship

- Ability to adapt to evolving circumstances and swiftly respond to changes

- Communication skills

Master of Finance

On the other hand, choosing a Master of Finance program will provide you with an array of skills and attributes essential for excelling in the finance industry, including:

- Ability to evaluate financial data, identify trends and draw meaningful conclusions

- Proficiency in creating and managing budgets

- Strong foundation in mathematics and statistics

- Teamwork and collaboration skills

- Familiarity with financial software, spreadsheets and analytical tools for data analysis and reporting

- Proficiency in preparing accurate and comprehensive financial reports

- Critical thinking skills

- Thorough understanding of tax regulations

- Time management skills

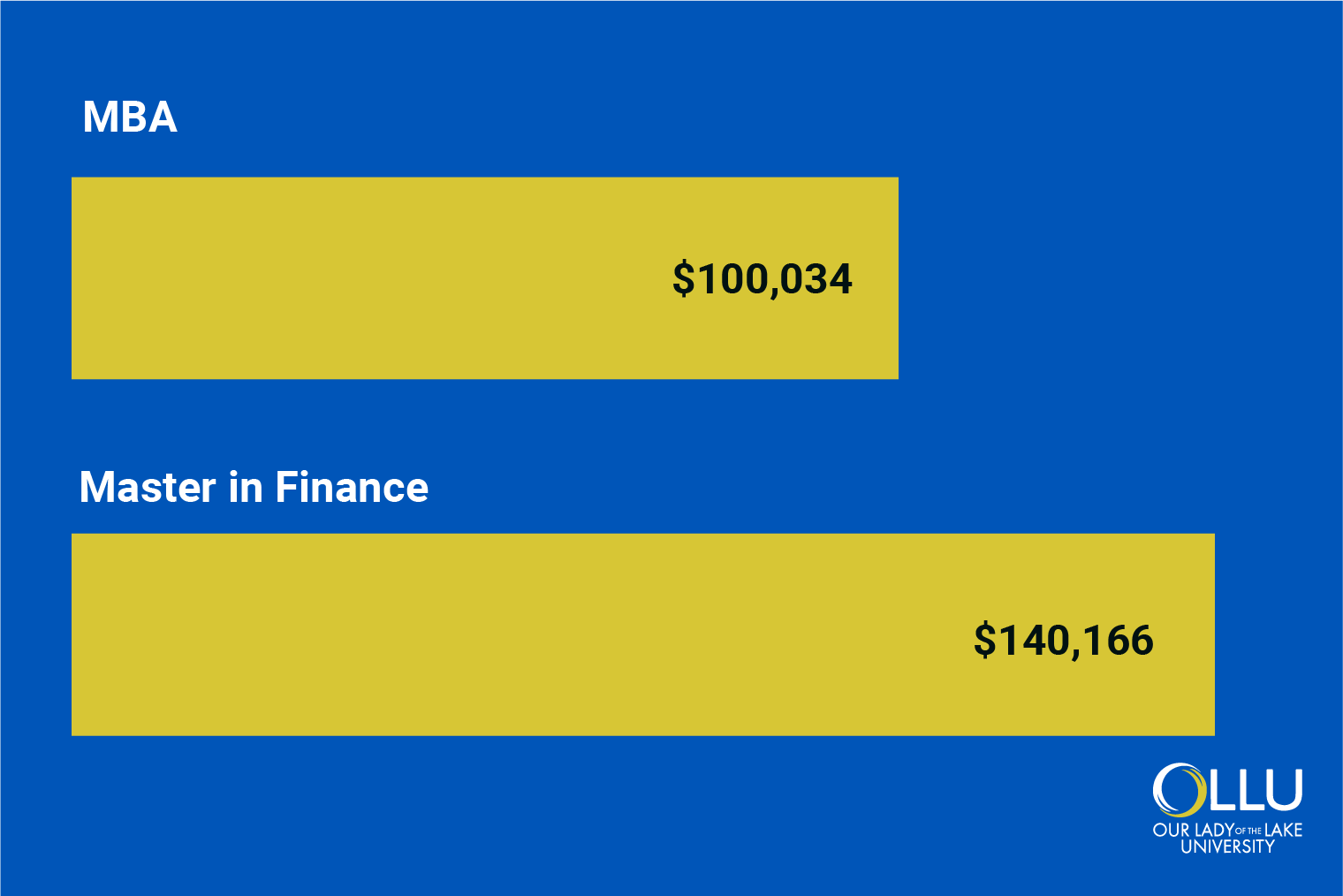

Financial Considerations

Considering the financial implications involved before embarking on a career path is important since understanding the potential return on investment is crucial for long-term financial stability and success.

Both pursuing an MBA and obtaining a Master of Finance degree can lead to lucrative career opportunities. In the United States, a Master’s in Finance offers an estimated total pay of $140,166 annually, with salaries ranging from $92,000 to $217,000. Conversely, an MBA program yields an estimated total income of $100,034 per year in the United States, with salaries spanning from $58,000 to $176,000.

Please keep in mind that the salary figures mentioned are approximate and may vary depending on a variety of factors, such as the job position, location, level of experience and other relevant factors.

Future Outlook

Recent data from the Bureau of Labor Statistics paints an optimistic future for graduates with an MBA or a Master of Finance degree. The outlook for management occupations, encompassing a diverse range of finance, administration and leadership roles, is promising. Their projections reveal that this sector is expected to experience a growth rate exceeding the average across all occupations from 2022 to 2032, with an estimated 1.1 million job openings annually, reflecting a substantial demand for proficient professionals in these areas.

Key Considerations When Choosing a Degree

As you navigate the process of selecting a degree program, there are several key considerations to bear in mind, as each one can notably shape your educational path.

Flexibility

If you’re juggling work or other commitments, prioritizing a flexible program is crucial for balancing your educational pursuits with existing responsibilities. This ensures you can seamlessly incorporate your learning into your professional and personal life.

Notably, our institution stands out as a top-ranked school for master’s degrees in 2023. We take pride in offering one of the best MBA programs in the state, tailored to accommodate the schedules of working professionals.

Interests and goals

Envisioning your long-term aspirations and aligning them with your chosen degree program is another important step in ensuring a fulfilling educational journey. By carefully considering your professional goals, you can effectively match the offerings of the degree with what you aim to achieve. This approach ensures that your investment is tailored to push you toward your desired career path, providing a solid foundation for success in the years ahead.

Job market

Next, to make an informed decision about your degree, it’s essential to understand the job market dynamics in your specific geographic area. Researching employment trends can provide valuable insights into thriving industries and professions, giving you a clearer picture of opportunities thus helping you align your educational pursuits with the demands of the job market, ultimately increasing your chances of securing a rewarding and stable career upon graduation.

Educational prerequisites

Some roles may necessitate advanced degrees, specific certifications or specialized training to qualify. Therefore, it is best to be well-informed about the educational prerequisites of the career you want to pursue.

Our school provides opportunities to enhance your qualifications with programs like the Financial Analysis and Corporate Performance certificate or Business Analytics and Intelligent Decision Making certificate. Each program will equip you with the specialized knowledge and credentials to excel in your chosen field.

Curriculum

When considering a degree program, ensuring that the curriculum aligns with your educational and career goals is essential. A well-designed curriculum should include a variety of courses that will give you a solid foundation of knowledge and relevant skills for your desired field. By closely examining the available courses, you can feel assured that you’ll gain comprehensive and practical knowledge, which will prepare you to succeed in your future career pursuits.

The Bottom Line

Both an MBA and a Master’s in Finance are esteemed postgraduate degrees designed to equip you with the essential skills and knowledge needed to pursue diverse and rewarding career paths.

An MBA primarily prepares you for managerial and leadership roles, providing a comprehensive understanding of business operations and strategic decision-making. On the other hand, a Master’s in Finance focuses on specialized financial expertise, exploring areas like investment analysis, risk management and financial markets. Both paths offer distinct benefits, including competitive salaries and promising job outlooks.

If either of these paths aligns with your aspirations, we welcome you to embark on your journey toward success with our exceptional range of degree and certification programs.

FAQ

Is a Master of Finance worth it?

Yes, a Master of Finance is worth pursuing if you seek specialized knowledge and skills for finance-related roles.

Is it better to have an MBA or a Master of Finance?

It depends on your career goals; MBAs are better for management roles and Master of Finance degrees for finance-specific positions.

Is an MBA higher than a Master of Finance?

No, they are both at the same level of postgraduate academic degree.

Which is harder: an MBA or a Master of Finance?

Difficulty varies based on your individual strengths and interests.

Which pays more: an MBA or a Master of Finance?

Overall, Master of Finance degree holders earn a higher average salary. However, it all depends on factors like industry, location and job role, among other factors.

Which degree is cheaper: an MBA or a Master of Finance?

The cost of the degree varies by program and institution.