What Does a Financial Analyst Do?

Mar 13, 2024

In the dynamic world of business, where every little decision counts, financial analysts

emerge as specialized professionals who decipher complex data to guide strategic decisions

that can shape the success of an organization. Their duties go beyond analyzing balance

sheets and forecasting market trends, as financial analysts are invaluable in distilling

large volumes of financial information into actionable insights.

The business world is ever-evolving, so the demand for skilled financial analysts is growing in industries beyond finance and technology to government and healthcare. Join us as we delve deeper into what a financial analyst does, some of the essential skills for financial analysts, and more.

What Is a Financial Analyst?

Financial analysts examine financial data and use their findings to help organizations make informed decisions about budgeting, investments, and overall financial strategies. They examine financial statements, create financial models to forecast future performance, and examine current events in the market. Therefore, they play a pivotal role in assisting senior management in achieving financial goals.

So, how to become one? A bachelor's degree in accounting, business, economics, or finance is the minimum educational requirement to become a financial analyst. However, a master's degree or the Chartered Financial Analyst (CFA) certification can be helpful for more advanced positions.

Types of Financial Analysts

While financial analysts can work in various organizations and establishments and hold different job positions, the two significant types are buy-side and sell-side analysts. While both function together and provide investment recommendations and insights to investors, they differ in the type of clients they serve.

Sell-side analysts are research financial professionals who evaluate companies and industries to understand their value in the stock market and identify investment opportunities for their clients. They can work with individual clients or investment banks to increase their capital. Sell-side analysts create thorough reports with helpful information for their clients and provide recommendations to guide them in making informed investment decisions.

Buy-side analysts provide investment recommendations to their clients. They combine their independent research with sell-side research interpretations to offer actionable solutions to their clients. Usually, they work for institutional investors such as mutual funds, hedge funds, and pension funds. While they don't usually have the final say in how their clients spend their money, their research in uncovering trends and making forecasts plays a pivotal role in decision-making.

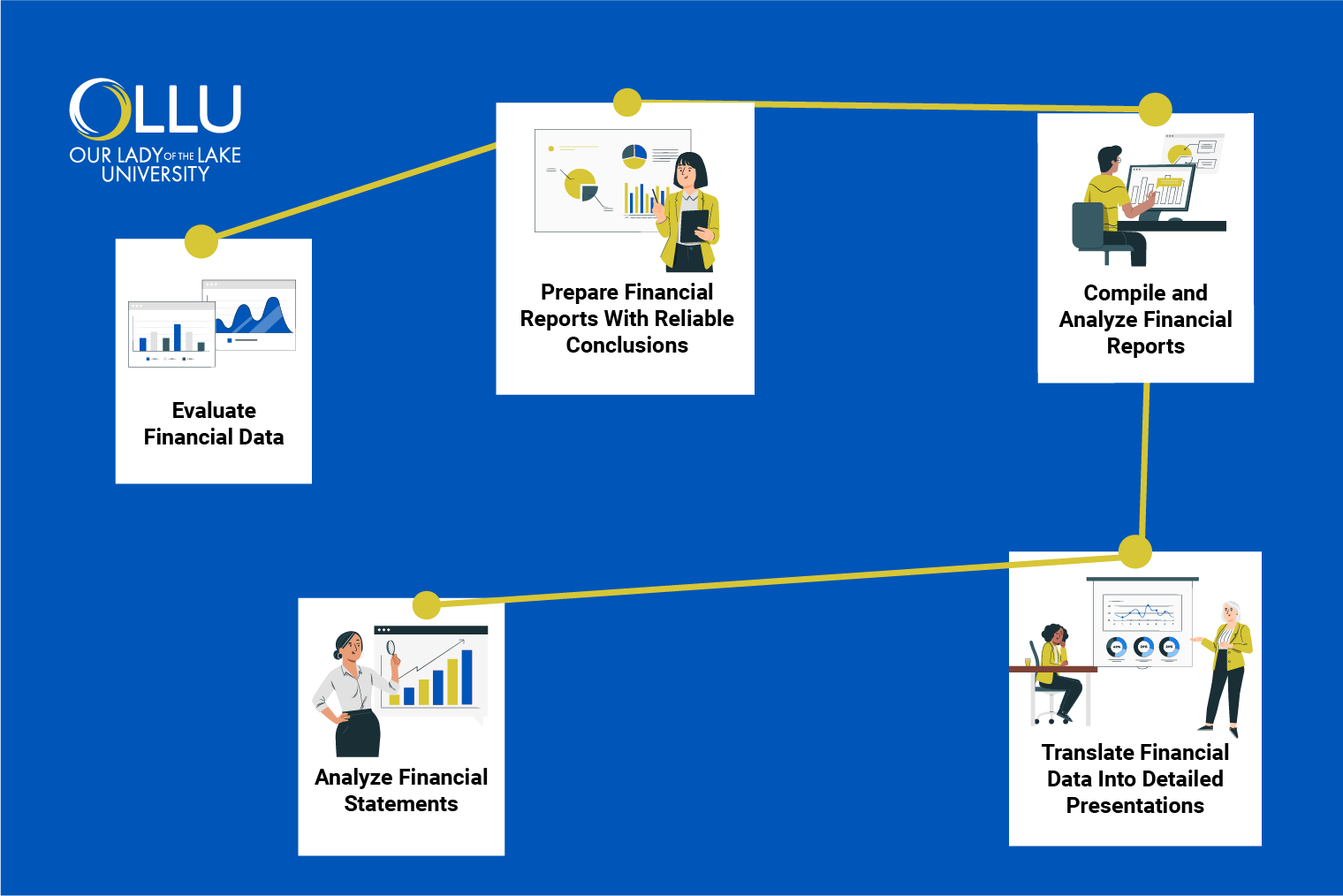

What Does a Financial Analyst Do?

Financial analysts perform a wide range of tasks to gather data, organize, assess,

and interpret financial information, make forecasts and projections, and make recommendations

to their clients. They combine analytical skills and industry knowledge to contribute

to a company's financial success.

Although the primary responsibilities of financial analysts vary depending on their level of expertise and career path, some of their daily duties include the following:

- Evaluating financial data and identifying economic and business trends

- Preparing financial reports with reliable conclusions

- Compiling and analyzing financial reports

- Recommending individual or a collection of investments

- Monitoring the performance of stocks, bonds, and other types of investments

- Translating financial data into detailed presentations

- Communicating with executives from client companies to understand company needs

- Analyzing financial statements to evaluate investment opportunities

Junior Level

A junior financial analyst position is an entry-level role that provides opportunities for participation in projects or analyses, such as assisting in collecting data on market trends to support senior analysts, supporting senior analysts in building financial models for forecasts, assisting in collecting data on market trends and competitors, etc. Usually, to advance in their career, they go back to school to earn a master's degree. While their duties vary depending on the expectations of the company they work for, some of the duties they perform are:

- Maintaining the database and performing tasks like data entry, backups, and verification

- Managing and coordinating the primary financial measurements (cash flow, gross profit, expenses, profit, and revenue) and providing advice on the most effective methods to cut costs

- Carrying out business business studies, investigating accounts, and investigating reports from suppliers

- Performing analyses of the budget and costs, reviews, and advisory services concerning the financial status of the company

- Contributing to the making of the financial reports

Senior Level

Senior financial analysts usually have a master's degree and work on large accounts. They play a valuable role in decision-making, impacting strategic planning and financial management, and contribute to strategic planning by assessing the financial implications of different strategic options. They also evaluate potential investments, acquisitions, and mergers, thus ensuring the resource allocation is effective and aligned with the company's strategic objectives. While they manage junior financial analysts, they report to their organization's CFO or financial manager. Some of the more advanced tasks and strategic responsibilities they take on an organization are:

- Forecasting quarterly and annual profits

- Developing financial models through process analysis and benchmarking

- Preparing cost projections

- Conducting thorough research of historical financial data

- Reviewing accounting transactions for data accuracy

- Establishing financial policies

- Coordinating with the CFO and the executive team on long-term financial planning

Manager Level

Manager financial analysts take on a leadership role by overseeing teams of junior and senior financial analysts and providing guidance and mentorship to ensure the team's effectiveness in meeting goals. They also develop trends and projections for the organization's finances, oversee operations of the finance department, and set goals and objectives by utilizing their expertise in strategic financial planning. By leading teams, guiding strategic financial planning, and fostering a culture of continuous improvement within financial analysis, manager financial analysts contribute to the success of an organization.

Essential Skills for Financial Analysts

To succeed in the financial analysis field, you'll have to combine a set of hard skills and soft skills, such as:

- Analytical skills: A competent financial analyst is able to plan, prioritize, forecast, and recognize financial problems, which are correlated to excellent analytical skills. Moreover, they're able to interpret complex data and make informed decisions.

- Attention to detail: Financial analysts have to deal with large amounts of financial data with precision, so attention to detail is necessary to deliver accurate and reliable results.

- Financial modeling: Financial modeling is the digital presentation of a company's financial performance. Therefore, proficiency in financial modeling is an essential skill for forecasting cash flow, balance sheets, business income statements, and more to make investment decisions.

- Communication and interpersonal skills: Financial analysts have to interact with stakeholders, investors, clients, and representatives of companies, so they must possess strong communication and interpersonal skills to navigate the corporate world. These skills are crucial for expressing financial information comprehensively to influence investors and clients.

- Technical skills: To perform effectively, financial analysts must display proficiency in financial software and tools such as Hyperion, QuickBooks, SAP, SQL, etc. This way, they can use databases and spreadsheet software to enhance productivity and data management.

- Critical thinking skills: By utilizing critical thinking skills, financial analysts are able to solve problems and identify the best investments for the company. Moreover, they can make financial data-driven decisions on whether to sell or buy an asset.

Salary and Job Outlook for Financial Analysts

Due to their indispensable value in making informed investment strategies and the increased economic activities, financial analysts are in high demand, as the overall employment of financial analysts is estimated to increase by 8% this decade, with about 27,400 openings projected each year. With experience, they can move up and become senior financial analysts, portfolio managers, or fund managers.

Financial analysts also benefit from a promising compensation of $95,080 within the 10th and 90th percentile of $58,950 to $169,940. However, the average salary depends on factors like experience and location. The average wage for entry-level positions, such as junior financial analysts, is $58,023. On average, experienced financial analysts, such as senior financial analysts, can make $117,265. Differences in financial analysts' salaries are also present in relation to location, as financial analysts living in states with a higher cost of living, such as New Mexico, Alaska, California, and New York, are compensated more than financial analysts who live in states with a lower state of living such as Texas, Georgia, and North Dakota.

The Bottom Line

Due to the ever-changing landscape of the business world, financial analysts play a pivotal role in guiding companies with their strategic thinking, analytical skills, and profound understanding of financial intricacies. This has led to a high demand for financial analyst positions and substantial compensation for their commitment.

While financial analysts can take on different levels of responsibilities, financial analysts of each level play a crucial role in investment decisions, strategic planning, risk management, and resource allocation. Financial analysts help shape companies into success stories, so if this exciting career intrigues you and you want to learn more about how you can get started, contact us here!

Frequently Asked Questions (FAQs):

What qualifications are required for a career as a financial analyst?

The main requirement to become a financial analyst is earning a degree in accounting, business, economics, or finance. To become a financial analyst, you'll also need to gain strong analytical skills, attention to detail, and proficiency in financial modeling. To further your knowledge and enhance your credentials, you can pursue master's studies or obtain the CFA certification or other certifications.

Can one earn a substantial income as a financial analyst?

Yes, you can earn a substantial income as a financial analyst. Although the actual salary of financial analysts depends on factors like location, years of experience, industry, and additional skills, on average, financial analysts make $95,080. After becoming a financial analyst, you can increase your earning potential by obtaining advanced certifications in the field.

Is the role of a financial analyst stressful?

Being a financial analyst can be occasionally stressful, especially when dealing with tight deadlines and large amounts of data. Another factor contributing to stress is constantly staying up-to-date with the latest market trends.

Is being a financial analyst a challenging job?

Being a financial analyst can be challenging, as you'll have to make quick decisions after analyzing specific data. You'll also have to meet quotas by a certain deadline constantly, and adapting to changes in the industry can contribute to the overall challenges of the job. Moreover, you might have to work long hours, which can lead to unhealthy work-life balance.