Guide to a Successful Career Change to Finance

Mar 14, 2024

In recent years, there has been a noticeable increase in people opting for a career

change to finance, marking a significant trend in professional transitions. As industries

evolve and new opportunities emerge, more and more professionals are recognizing the

allure of the finance sector for its dynamic nature, lucrative prospects, and the

promise of personal growth.

Motivated by diverse factors ranging from the desire for financial stability to pursuing passion and purpose, individuals are increasingly drawn to finance, seeking avenues to leverage their skills and expertise to pursue a rewarding and fulfilling career path. This blog serves as a compass for those considering or currently navigating a career change into finance, offering insights and strategies to navigate this transition successfully.

How to Start Your Career in Finance

Starting a career in finance involves careful planning and decisive steps. It's essential to consider the various options available in the finance sector and to gain the required skills and qualifications. In the following sections, we'll explain each step, offering practical advice to guide you toward a rewarding finance career.

Education

A solid educational foundation is essential for success in the finance sector, serving as the cornerstone to build a thriving career. Pursuing a finance degree from a reputable institution offers comprehensive knowledge and practical skills essential for navigating the complexities of the financial world. Whether through a Bachelor of Business administration degree, an MBA or a Master of Finance degree, or a degree in related fields like economics or accounting, obtaining formal education equips you with a deep understanding of financial principles, investment strategies, risk management techniques, and regulatory frameworks. Additionally, certifications such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) can further enhance expertise and credibility in the industry.

Build financial knowledge

Expanding financial knowledge is essential for remaining competitive and adaptable in the ever-evolving finance landscape. Staying up-to-date on current trends, market developments, and emerging technologies is crucial for making informed decisions and seizing opportunities.

Online courses, workshops, and seminars provide convenient and flexible avenues for professionals to deepen their understanding of finance. Platforms like Coursera, Udemy, and LinkedIn Learning offer courses covering diverse topics such as financial analysis, investment strategies, and fintech innovations. Additionally, attending industry conferences, joining professional associations, and participating in networking events can facilitate knowledge exchange and foster valuable connections within the finance community.

Develop key skills

Developing essential skills is crucial for thriving in the fast-paced and demanding field of finance. Analytical thinking is necessary for interpreting complex data and identifying trends, enabling professionals to make well-informed decisions and develop effective strategies. Attention to detail ensures accuracy in financial analysis and reporting, protecting against errors that could have significant repercussions. Problem-solving skills are also vital for navigating challenges and finding innovative solutions to address financial issues or capitalize on opportunities. By honing these abilities, you can enhance your effectiveness in various roles within the finance industry, from investment analysis to risk management and financial planning.

Internships and entry-level positions

Internships and entry-level positions serve as invaluable stepping stones for launching a successful career in finance, offering hands-on experience and valuable insights into the workings of the industry. Internships provide opportunities to apply theoretical knowledge in real-world scenarios, develop practical skills, and build professional networks. When seeking entry-level positions in finance, it's essential to leverage resources such as career fairs, online job boards, and networking events to identify opportunities. Tailoring resumes and cover letters to highlight relevant skills and experiences can enhance visibility to potential employers. Once in a position, aspiring finance professionals should approach their roles with enthusiasm, eagerness to learn, and a strong work ethic.

Networking

Networking is pivotal in the finance industry, facilitating opportunities for career advancement, knowledge exchange, and professional growth. Attending industry events, such as conferences, seminars, and networking mixers, provides avenues to connect with peers, industry leaders, and potential mentors.

Joining professional organizations like the CFA Institute or the Financial Planning Association offers access to valuable resources and educational opportunities and fosters relationships with like-minded professionals. Lastly, leveraging online platforms like LinkedIn enables individuals to expand their professional network, showcase their expertise, and stay updated on industry trends and job opportunities.

Obtain Certifications

In finance, certifications enhance professional competence and open doors to career advancement and opportunities. Recognized certifications in finance include the Chartered Financial Analyst (CFA) designation, which attests to proficiency in investment analysis and portfolio management and is highly respected globally.

Another esteemed certification is the Certified Financial Planner (CFP) designation, which demonstrates financial planning, retirement planning, estate planning, and insurance expertise. Additionally, the Financial Risk Manager (FRM) certification signifies proficiency in managing financial risk, while the Certified Public Accountant (CPA) credential showcases expertise in accounting and financial reporting.

Stay technologically savvy

Staying technologically savvy is crucial in the modern finance landscape, where technological advancements reshape industry practices and processes. Integrating artificial intelligence, machine learning, and big data analytics has revolutionized financial services, from algorithmic trading to risk management and customer service. To remain competitive, finance professionals must stay up-to-date on emerging technologies and their applications in the industry. This involves keeping up-to-date with financial software, tools, and platforms designed to streamline operations, enhance decision-making, and improve efficiency. Familiarity with financial modeling software, data visualization tools, and blockchain technology can provide a competitive edge in today's digital-centric finance environment.

Build a strong resume

Building a strong resume is essential for making a lasting impression in the competitive field of finance. When crafting a finance-focused resume, it's crucial to tailor it to highlight relevant skills, experiences, and achievements. Begin by briefly summarizing your professional background, including education, certifications, and relevant coursework. Emphasize quantitative skills such as financial analysis, modeling, and forecasting and proficiency in appropriate software and tools such as Excel, Bloomberg Terminal, and financial databases. Showcase any internships, projects, or volunteer experiences that demonstrate your ability to apply financial concepts in practical settings and contribute to the success of teams or organizations. Lastly, quantify your achievements whenever possible, whether it's optimizing financial processes, exceeding performance targets, or delivering measurable results.

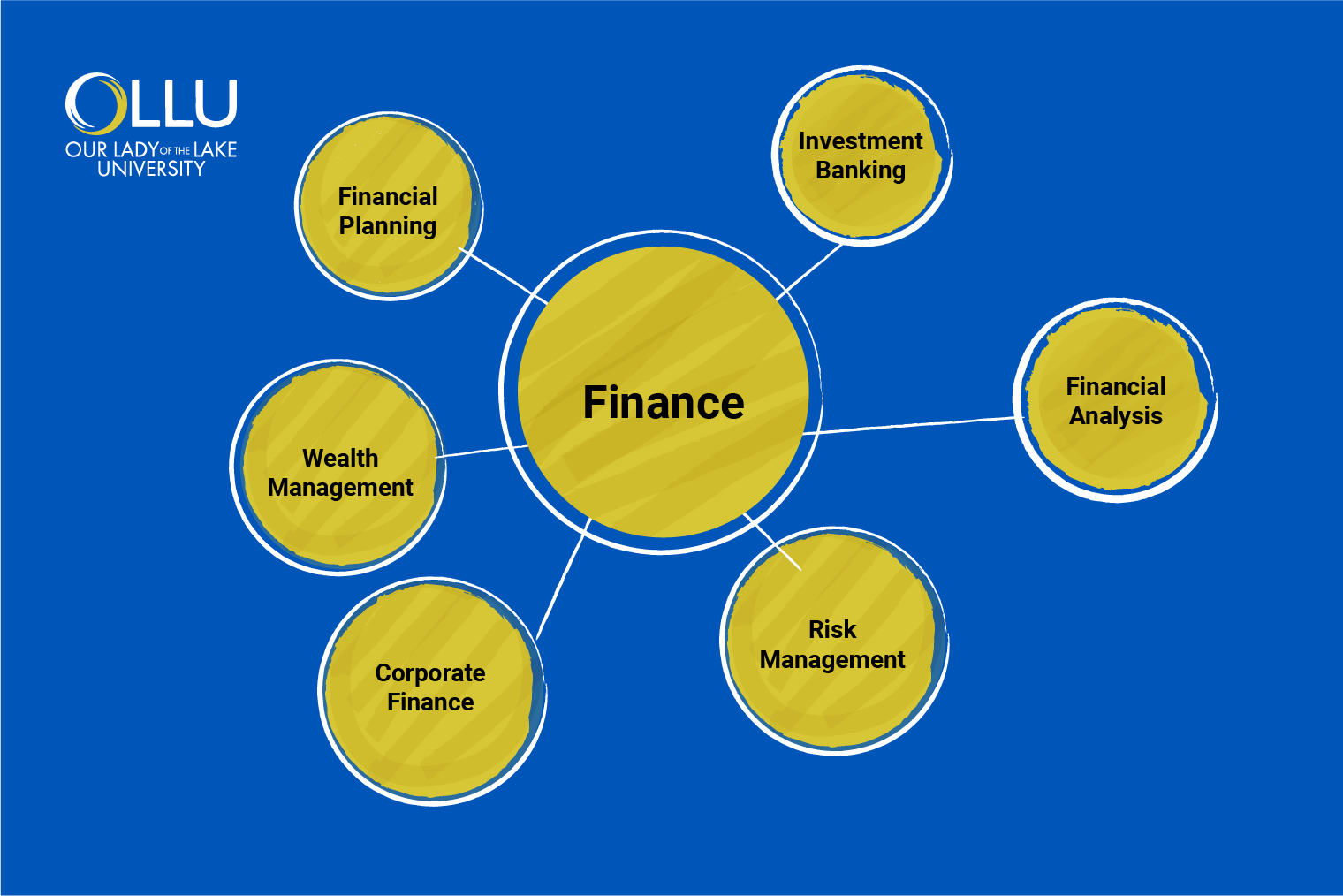

Careers Paths in Finance

The field of finance offers a myriad of career paths, each with its unique opportunities

and challenges. Investment banking is renowned for its fast-paced environment and

involvement in capital raising, mergers, and acquisitions. Financial analysis involves analyzing financial data to inform investment decisions and strategic planning.

Risk management identifies and mitigates financial risks to protect assets and optimize

performance. Corporate finance professionals manage financial activities within companies,

including budgeting, forecasting, and capital allocation. Wealth management entails

providing personalized financial advice and investment strategies to high-net-worth

individuals and families. Additionally, roles in financial planning and analysis,

asset management, and financial consulting offer diverse avenues for finance professionals

to pursue their interests and expertise.

Common Jobs in Finance

Common finance jobs encompass various roles tailored to different specialties and skill sets. Financial analysts assess financial data to provide insights for investment decisions, typically requiring a bachelor's degree in finance or related fields. Financial advisors offer personalized financial guidance to clients, often necessitating a bachelor's degree and relevant certifications such as the Certified Financial Planner (CFP). Accountants manage financial records and ensure compliance with regulations, typically requiring a bachelor's degree in accounting or finance and CPA certification. Investment bankers facilitate capital raising and mergers/acquisitions, often requiring a bachelor's degree in finance or economics and strong analytical and interpersonal skills. Risk managers identify and mitigate financial risks, usually requiring a bachelor's degree in finance or a related field and expertise in risk assessment methodologies. Each of these roles offers opportunities for career progression, with senior positions often demanding additional experience, certifications, or advanced degrees.

Challenges and Considerations

Transitioning to a finance career comes with its set of challenges and considerations. Adapting to a new work environment and industry can be daunting for those making the switch. The finance sector is known for its fast-paced and competitive nature, requiring newcomers to quickly acclimate to high-pressure situations and demanding expectations. Achieving a balance between work and personal life can also be challenging, especially in roles with long hours and tight deadlines. Moreover, navigating the intricate dynamics of the finance industry, building professional networks, and establishing credibility can take time and effort. It's essential for those transitioning to finance to be prepared for these challenges and to proactively seek support, mentorship, and resources to aid in their integration into the field. Maintaining resilience, staying adaptable, and continuously honing skills and knowledge are crucial for overcoming obstacles and thriving in a finance career.

Key Takeaways

Transitioning to a finance career demands strategic planning, continuous learning, and proactive networking. Obtaining relevant education, staying updated on trends, and leveraging technology are essential. Building a solid network, pursuing certifications, and exploring diverse paths enhance credibility and opportunities. However, one must overcome challenges like adapting to a new environment and maintaining a work-life balance. Embracing these strategies and remaining resilient paves the way for a fulfilling finance career.

Ready to take the next step toward a rewarding career in finance? Explore OLLU's comprehensive finance program today and unlock your potential.

Frequently Asked Questions (FAQs):

Can I transition into finance without a finance degree?

Yes, transitioning into finance without a finance degree is possible. Many roles value skills and experience over specific degrees. Additional education, certifications, or relevant experience can facilitate the transition.

How do I determine which sector of finance to pursue?

Determine your interests, strengths, and career goals—research different sectors like investment banking, financial analysis, risk management, and asset management. Seek informational interviews or shadow professionals to gain insights before deciding.

Is the age of 40 considered too late to embark on a career in finance?

No, age 40 is not too late to start a finance career. Many individuals switch careers or pursue further education later in life. Assess your skills, experience, and motivation, and invest in additional education or networking opportunities as needed. Success in finance is achievable at any age with determination.