Business Analyst vs Financial Analyst: What Is the Difference?

Mar 05, 2024

In today's business world, Business Analysts and Financial Analysts play crucial roles

in organizational success. These professionals contribute unique expertise to business

decision-making. This blog aims to clarify the differences between Business Analysts

and Financial Analysts, highlighting their distinct responsibilities, skills, and

goals. By examining these subtle yet important distinctions, we offer a comprehensive

understanding of the differences in the roles of a business analyst and a financial

analyst.

Whether you're considering career options, improving your business strategy, or just

curious about these professions, this blog guides you in understanding the specific

contributions of a Business Analyst vs a Financial Analyst in the corporate world.

Understanding the Basics

At the core of business and financial analysis lie fundamental concepts for informed decision-making. Business analysis involves systematically examining an organization's structure, processes, and systems to identify opportunities for improvement. On the other hand, financial analysis primarily deals with evaluating an entity's financial health by scrutinizing its financial statements, ratios, and performance indicators. Below, we analyze each in detail.

What Is a Business Analyst?

A Business Analyst's role is to bridge the gap between business needs and technological solutions within an organization. Acting as a liaison between stakeholders, including management and IT teams, a Business Analyst is tasked with understanding and analyzing business processes, systems, and objectives. Their responsibilities encompass identifying areas for improvement, proposing efficient solutions, and facilitating the implementation of these changes. Business Analysts leverage data analysis, modeling, and communication skills to translate complex business requirements into precise specifications for development teams. Doing so enhances operational efficiency, innovation, and overall organizational success. The role of a Business Analyst is dynamic, requiring adaptability to changing business landscapes and a keen ability to align technology solutions with strategic business goals.

What Is a Financial Analyst?

A Financial Analyst plays a crucial role in dissecting and interpreting an organization's financial data, providing key insights that inform strategic decision-making. Their primary functions include examining financial statements, assessing economic trends, and evaluating investment opportunities. Financial Analysts use various quantitative and qualitative methods to analyze a company's financial health, calculating ratios and identifying patterns to gauge performance. They are pivotal in forecasting future financial scenarios and helping organizations make informed decisions about budgeting, investment, and resource allocation. Financial Analysts often collaborate with other departments to ensure financial strategies align with overall business objectives. In essence, the role of a Financial Analyst is instrumental in guiding financial decisions, optimizing resource allocation, and contributing to the organization's fiscal well-being.

Education Requirements

Both Business Analysts and Financial Analysts require strong educational foundations. Business Analysts usually hold bachelor's degrees in business administration, management, or related fields, often complemented by certifications like CBAP. Financial Analysts typically have degrees in finance, accounting, economics, or a related discipline, frequently pursuing certifications such as CFA. Both roles demand strong analytical, communication, and problem-solving skills for effective data interpretation and stakeholder communication.

Business Analyst

Prospective Business Analysts benefit from a solid educational background in business-related fields, typically requiring a bachelor's degree in business administration, management, or a related discipline. Aspiring Business Analysts often pursue additional certifications like CBAP to enhance their skills and marketability. Recommended courses cover business analysis methodologies, data analytics, project management, and systems analysis, providing essential knowledge and practical skills for navigating organizational complexities. Individuals can further advance their expertise with specialized programs such as an MS in Business Analytics Online, offering a convenient and flexible option for continued education in this dynamic field. The combination of a relevant degree, targeted certifications, and specialized programs equips individuals to excel in the dynamic field of business analysis.

Financial Analyst

A career as a Financial Analyst typically necessitates a strong educational background in finance, accounting, economics, or a closely related field. Aspiring Financial Analysts commonly possess at least a bachelor's degree, offering a comprehensive understanding of financial principles and analytical techniques. Many individuals pursuing this path enhance their expertise by seeking professional certifications like the Chartered Financial Analyst (CFA) designation, involving a rigorous program covering investment analysis, portfolio management, and ethical standards. Supplementary coursework in financial modeling, statistical analysis, and risk management complements their formal education, providing the requisite knowledge and skills for success in financial analysis. For those considering advanced education, the choice between an MBA vs. Master of Finance becomes significant, with specialized programs like MS Financial Analysis Online offering a convenient and flexible online platform for further expertise in this dynamic field.

Career Opportunities

Business Analysts and Financial Analysts have diverse career paths with opportunities for specialization. Business Analysts find roles in various industries, including information technology, healthcare, and finance, evolving into positions like Systems Analysts or Project Managers. On the financial side, Financial Analysts explore roles in investment banking, corporate finance, risk analysis, or portfolio management, advancing to positions like Finance Manager or Chief Financial Officer (CFO). Both professions offer flexibility for specialization in areas such as data analysis or strategic planning, allowing individuals to tailor their careers to align with their interests and strengths.

Business Analyst

Business Analysts are highly sought-after across industries for their vital role in aligning business objectives with technological solutions. In the information technology sector, they facilitate software development projects, acting as liaisons between stakeholders and development teams. In healthcare, Business Analysts optimize processes for better patient care. Financial institutions value their expertise in analyzing financial data and improving operational efficiency. In retail and e-commerce, they enhance customer experiences and streamline supply chain operations. The increasing recognition of data-driven decision-making elevates demand for skilled Business Analysts in diverse sectors like manufacturing, telecommunications, and consulting. Their adaptability allows them to thrive in dynamic environments, making them indispensable assets.

Financial Analyst

Financial Analysts play crucial roles across diverse industries, navigating complex financial landscapes. In investment banking, they assess risk and analyze market trends for investment decisions. Corporate finance relies on them for budget management, financial forecasting, and resource optimization. The insurance and consulting sectors depend on their analytical skills for risk analysis and management. Financial Analysts contribute to project financing and assess financial viability in the energy industry. They evaluate the financial health of institutions and aid in strategic financial planning in the healthcare sector. In technology, retail, and manufacturing, they guide financial strategies and support decision-making. The adaptability of Financial Analysts across industries underscores their significance in shaping sound financial practices and fostering organizational success.

Skill Sets and Traits for Success

Success in business and financial analysis roles requires a blend of technical skills

and personal attributes. Analysts must possess analytical prowess to interpret complex

data, communication skills to convey insights, and adaptability to navigate changing

environments. Attention to detail is crucial, particularly when handling financial

data. A strategic mindset is essential for aligning analyses with business objectives,

and collaboration skills are vital for successful cross-departmental work. Lastly,

a commitment to continuous learning ensures professionals stay current with industry

trends and technological advancements, contributing to long-term success in dynamic

landscapes.

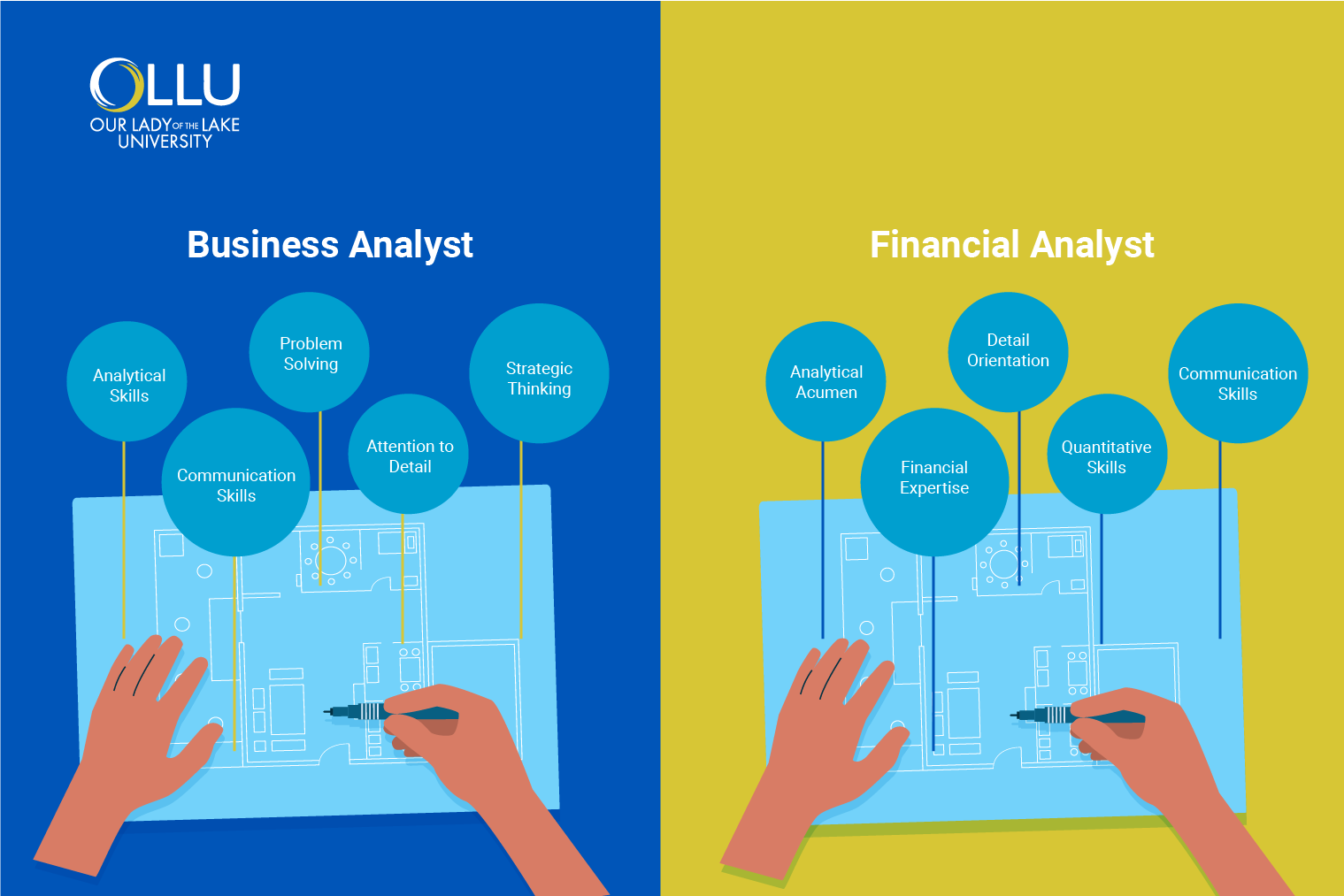

Business Analyst

Business Analysts excel with a specific set of crucial skills:

- Analytical skills: Assess and interpret complex business processes effectively

- Communication skills: Convey technical information clearly to various stakeholders

- Problem-solving abilities: Identify challenges, propose solutions, and optimize business operations

- Adaptability: Navigate evolving business landscapes and adjust strategies

- Attention to detail: Ensure precision in analyzing data and requirements for accurate assessments

- Strategic thinking: Align analyses with overarching organizational goals

- Interpersonal skills: Build strong relationships and collaborate seamlessly with diverse teams

- Proactive learning: Commitment to staying ahead of industry trends and emerging technologies

- Project management: Organize and oversee projects for effective implementation

Financial Analyst

Financial Analysts leverage a distinctive set of essential skills and traits:

- Analytical acumen: Proficiency in dissecting financial data for actionable insights

- Financial expertise: Strong understanding of financial principles, accounting practices, and economic trends

- Detail orientation: Exceptional attention to detail for accuracy in handling financial statements

- Quantitative skills: Adeptness in utilizing quantitative techniques and financial modeling for decision-making

- Communication skills: Clear communication to convey financial insights to diverse stakeholders

- Problem-solving capability: Ability to address financial challenges and propose strategic solutions

- Adaptability: Flexibility to navigate changing market conditions and adjust financial strategies

- Ethical judgment: Sound ethical judgment and adherence to financial regulations

- Time management: Efficient time management to meet deadlines for timely financial analyses

- Team collaboration: Collaboration with cross-functional teams to integrate financial perspectives

Financial Considerations

Entering a career in business or financial analysis involves various financial considerations. Salaries vary based on experience, location, and industry specialization. Both Business and Financial Analysts generally receive competitive compensation with opportunities for salary growth. Industry trends and organizational needs influence job market conditions. Professionals may enjoy additional financial perks, such as bonuses or benefits. Continuous learning through certifications can enhance earning potential, but weighing the return on investment against educational costs is essential. Staying informed about industry trends is crucial for sustained career growth and financial success in these dynamic fields.

Future Outlook

Business and financial analysis fields are evolving with emerging trends and technological advancements like data analytics, machine learning, and artificial intelligence. The demand for skilled analysts is set to grow as organizations recognize the value of data-driven decision-making. Integrating sustainability metrics and ESG considerations into financial analysis is gaining prominence, reflecting the global shift towards responsible business practices. Accelerated by technological innovations, remote work will impact these professions, providing opportunities for professionals to collaborate with diverse international teams. As industries become more interconnected, professionals with interdisciplinary skills, including business acumen and technological proficiency, are expected to be highly sought after in a dynamic and promising job market.

Key Considerations When Choosing a Degree

When choosing an educational path for a business or financial analysis career, consider factors like the institution's reputation and accreditation for job market credibility. Evaluate the curriculum's alignment with industry standards, emphasizing practical experiences such as internships. Assess program flexibility, especially for working students. Explore specializations like data analytics or financial modeling to enhance career prospects. Lastly, prioritize opportunities for networking, mentorship, and industry connections to build a robust professional network.

Bottom Line

Business and financial analysis success requires a combination of technical skills and personal attributes. Both professions emphasize adaptability, ethical judgment, and collaboration. Considerations for future trends, emerging technologies, and interdisciplinary skills are crucial when choosing an educational path. Factors such as institutional reputation, curriculum alignment, flexibility, specialization options, and networking play a vital role. The evolving landscapes of business and financial analysis offer exciting opportunities for individuals with evolving skill sets, and success in these professions depends on a strategic blend of technical proficiency, adaptability, and continuous learning.

Frequently Asked Questions (FAQs):

Which role is better: business analyst or financial analyst?

The choice between business analyst and financial analyst depends on personal interests and career goals; both roles offer unique opportunities.

Do business analysts work in finance?

Yes, business analysts can work in finance, as their skills in analyzing business processes are valuable in financial settings.

Can a financial analyst be a business analyst?

While there's overlap, a financial analyst typically focuses on financial data, while a business analyst deals with broader organizational processes. Transitioning between roles is possible with relevant skills.

Do business analysts make a lot of money?

Compensation varies, but experienced business analysts can earn competitive salaries influenced by industry, location, and expertise.